Hi good folks,

Example of the Intended Goal:

The ES is at 6408. I want to click the Ask in the Dom at 6412 and thus establish a Stop Limit Order at that price. If the Bid line touches 6412, a Limit Sell order is opened for 6412, with a 6 tick market order stop loss above it. To the extent I get filled behind the Limit orders and Market orders that came before me, I'm in position at my desired price with a built-in market stop loss.

The theoretical benefit is that I can get an order in without appearing on the book as a limit order. The market stop loss provides protection against the price hopping over a limit stop loss after the limit sell order is filled. I'll assume the risk of the price hopping over the limit sell order in the foregoing example and the risk of others in the queue exhausting the buyers before my sell order comes up in the queue.

I'll need the same Exit Strategy going the other way: a Stop Limit long with a pre-set market stop loss. And I'd ideally love to be able to trigger these Exit Strategies through a button click on the chart as well as the DOM.

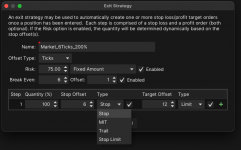

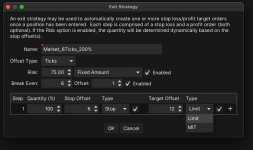

I already have a series of market order Exit Strategies with built-in brackets for the stop loss and take profit, and they work perfectly; see attached screenshots, which include the value list reflecting the order types offered by my broker. But I can't get my head around the stop limit series I'm trying to set up.

Is there any way to do this? And... assuming it's possible, am I missing anything that presents a dangerous risk that I'm unaware of?

Many thanks!

Example of the Intended Goal:

The ES is at 6408. I want to click the Ask in the Dom at 6412 and thus establish a Stop Limit Order at that price. If the Bid line touches 6412, a Limit Sell order is opened for 6412, with a 6 tick market order stop loss above it. To the extent I get filled behind the Limit orders and Market orders that came before me, I'm in position at my desired price with a built-in market stop loss.

The theoretical benefit is that I can get an order in without appearing on the book as a limit order. The market stop loss provides protection against the price hopping over a limit stop loss after the limit sell order is filled. I'll assume the risk of the price hopping over the limit sell order in the foregoing example and the risk of others in the queue exhausting the buyers before my sell order comes up in the queue.

I'll need the same Exit Strategy going the other way: a Stop Limit long with a pre-set market stop loss. And I'd ideally love to be able to trigger these Exit Strategies through a button click on the chart as well as the DOM.

I already have a series of market order Exit Strategies with built-in brackets for the stop loss and take profit, and they work perfectly; see attached screenshots, which include the value list reflecting the order types offered by my broker. But I can't get my head around the stop limit series I'm trying to set up.

Is there any way to do this? And... assuming it's possible, am I missing anything that presents a dangerous risk that I'm unaware of?

Many thanks!

Attachments

Last edited: