Hello all,

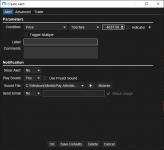

Relatively new to MotionWave and trying to get my head around the exit strategy function - for the most part I've got it sorted out, but I haven't been able to get the break-even function in the exit strategy to work - any suggestions? As a test, I set the stop-loss at .25%, the target at .5%, and then the break-even at .25%, expecting that if the price goes .25% or more in the direction of the target, the stop-loss will move automatically to the entry price - but so far, no luck - anything I'm missing?

Thank you!

Relatively new to MotionWave and trying to get my head around the exit strategy function - for the most part I've got it sorted out, but I haven't been able to get the break-even function in the exit strategy to work - any suggestions? As a test, I set the stop-loss at .25%, the target at .5%, and then the break-even at .25%, expecting that if the price goes .25% or more in the direction of the target, the stop-loss will move automatically to the entry price - but so far, no luck - anything I'm missing?

Thank you!